The first round of application for cost support was open until 31 August 2020. The second round of application for cost support will begin on 21 December 2020 and end on 26 February 2021 at 16:15. Do you have any questions about business cost support that relate to the second round of applications? You can send us your questions via the link at the end of this page. We will show the replies to these questions on this page so that others can access them as well.

Shortcuts to question topics

General information on cost support

Conditions for receiving cost support

Applying for cost support

Schedule

Ask about cost support

General information on cost support

When can I apply cost support?

The second round of application for cost support will begin on 21 December 2020 and end on 26 February 2021 at 16:15.

Why is there a second round of application?

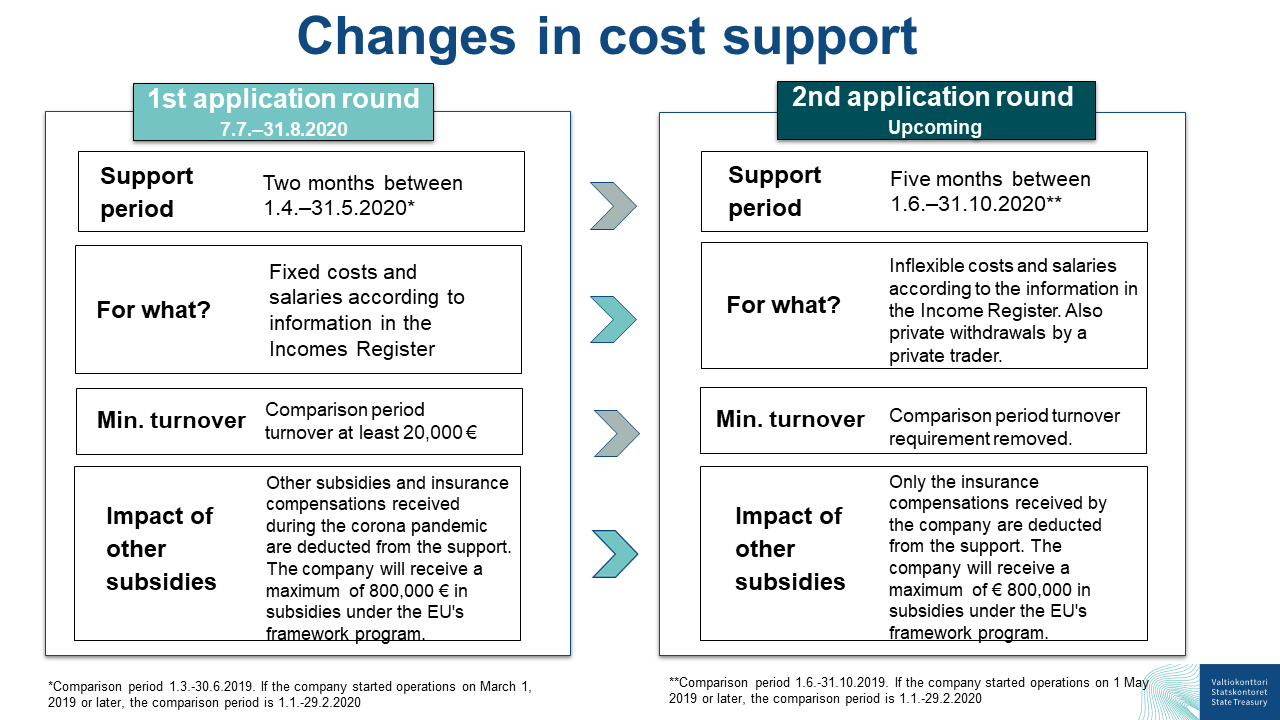

The government issued a proposal for the continuation of cost support on 29 October 2020. Amendments to the cost support system have been proposed in order to better meet the needs of companies, as the situation caused by the coronavirus pandemic will continue to be difficult for a number of sectors in autumn 2020.

How is the support changing?

Amendments have been proposed to make the cost support fit better with business needs. However, the basic principles for the support remain unchanged.

How large is the Cost Support?

The amount of support is specific to the company. At minimum the support is EUR 2,000 (support below EUR 2,000 is not paid) and at maximum it is EUR 500,000.

When can I apply for Cost Support?

The application period for Cost Support is from 21 December 2020 to 26 February 2020.

What is the meaning of classified information under the Act on the Openness of Government Activities?

According to the Act, all documents received by an authority become in principle public when the authority has received them. This also applies to applications for Cost Support. Anyone can request information on applications. An application for Cost Support may, however, in addition to public information, contain classified information, which will not be not published or passed on from the authority. If the applicant considers that there are trade or professional secrets in his/her application (according to the Act on the Openness of Government Activities) § 24 (1) (20)), the applicant may state in his/her application which information (s)he considers to be business secrets, and on what grounds the applicant considers this information to be confidential. In this way, the State Treasury receives information about which information in the application that the applicant himself considers to be trade secrets. According to the law, however, the State Treasury has final decision-making power on the extent to which the document should be classified.

All cost support decisions are in principle public. If a decision has specified information that the applicant has stated in the application to the State Treasury as trade or professional secrets, the decision may also partly contain information that has been stated as classified.

What is the framework support programme?

The support is granted under the EU Temporary COVID-19 Framework Program for Support (Commission Decision SA.56995). All aid granted under this framework is subject to a company specific cap of EUR 800 000, which may not be exceeded when the support is granted. When calculating the maximum amount of EUR 800 000, all support received by an individual company and of companies belonging to the same group as the one receiving grant under this frame shall be taken into account.

Conditions for receiving cost support

How will the support be allocated in the second round?

The intention for the second round of application is to continue to direct the support towards operational businesses and the expenses they face difficulties in covering by expanding and further specifying the expenses that can be covered and by extending the period of support. These measures aim to support companies facing a variety of different situations to adapt their operations in a future-orientated manner.

Will support already received influence the amount of support in the second round?

The bill proposes that cost support may be applied for even if the company has already received other direct support aimed at alleviating the consequences of the coronavirus pandemic. However, the support already granted is taken into account in determining the amount of the cost support, and the total amount of the support may not exceed EUR 800,000. This limit applies to both companies and corporate groups. The maximum amount of support per company is laid down in the European Commission’s regulations on temporary State aid.

Have there been any changes to the industry listing?

There has been changes to the industry listing. The new listing can be found here.

How are the inflexible expenses and losses defined?

The amount of the cost support depends on the other costs during the support period as reported by the company on the application. According to the Act on Cost Support, other costs during the support period refer to the inflexible operating costs and losses during the support period (1 June to 31 October 2020) justified by the company that are final and for which no cost support has previously been granted. The company must be able to distinguish the costs during the support period from other expenses it has declared on the application.

Inflexible costs cannot be adjusted in a way that corresponds with the volume of activities. In other words, even if the company does not have any sales, these expenses must be paid and it is not possible to adjust them according to decreased business activities unlike, for example, material and supplies costs or new investments.

The content of the inflexible costs that the amount of cost support is based on may be different for each company. Such costs include, but are not limited to, rental costs and other expenses concerning property used for business, equipment and item rentals, compensation for the right of access, licence fees, and necessary hired labour costs. Losses may include, for example, prepayments made by the company that have proved to be final.

The company must notify the State Treasury if the inflexible costs or losses indicated in the application later change, for example in the form of discounts received by the company or reductions in expenditure.

Below, you can find examples of expense types that can be considered inflexible costs and losses during the support period as referred to in the Act. Please note that the list is not exhaustive but only includes some examples. The eligibility of declared costs and losses is always decided on a company-specific basis when granting cost support.

Rental and other expenses on property used for business:

• Rental expenses related to the company’s property/premises (such as facility and property rent)

• Maintenance charge

• Electricity, water, gas, steam

• Security, facility surveillance or security systems

• Inflexible cleaning costs, waste management

• Property insurance premiums and property tax

• Statutory vehicle insurance premiums and taxes

• Road maintenance fees

• Interest expenses on a loan related to real estate

• Inflexible financial, accounting and audit costs

• Inflexible communications technology and phone plan expenses

• Maintenance costs for animals used in business

• Rental and bank guarantee costs

Equipment and item rentals

• Cost of leased vehicles

• Leased electronics (computers, monitors, phones, etc.)

License and access right fees

• Inflexible franchising fees

• Inflexible taxi hire company fees

• Royalty payments

• Computer software license fees

• Inflexible server costs (purchased from an external service provider)

Necessary hired labour cost

Necessary hired labour cost are considered to be e.g. hired labour costs that correspond to activities by the company’s own staff that are necessary for maintaining business or business readiness. Only necessary hired labour cost labour costs are eligible for the cost support. Upon request, the company must present a report on the necessity of using hired labour to maintain the company’s business.

Inflexible losses

Inflexible losses may include, for example, prepayments made by the company that have proved to be final. This may include advance payments made by a tour company to hotels or service providers for which the company has not received any refunds despite the cancellation of the trip. Upon request, the company must be able to verify that the losses indicated in the application are final and cannot be reasonably refunded by the receivers of the prepayments or other parties.

Examples of types of costs which cannot in principle be considered as eligible inflexible costs or losses:

• Depreciation and amortisation

• Statutory pension insurance for self-employed people and earnings-related pension payments

• Health care

• Write-downs

• Loan repayments and capital expenditure charge

• Instalments

• Non-recurring costs

• Fuel (material and supplies expenses)

• Membership payments

• Credit loss

• Bank charges

• Management costs for loans guaranteed by Finnvera

• Marketing costs

As a taxi entrepreneur/professional driver, I incur various expenses for my tool – the car. Is it possible to include such costs as part of the criteria for determining cost support?

The determination of the cost support is affected by costs of the support period declared by the company. According to the Act on Cost support, costs during the support period refer to inflexible business costs and losses (see above) for the support period (June 1 to October 31, 2020) that are reasonably demonstrated by the company and are final and for which no cost support has previously been granted.

Vehicle-related costs can also be supported by cost support. For example, leasing payments or car loan interest costs can be taken into account when determining cost support. Loan repayments or installments cannot be supported by cost support, as cost support cannot be granted for investment costs.

Statutory vehicle insurance premiums and vechile taxes may also be accepted. In addition, voluntary car insurance is acceptable if it has been necessary for the company to take out insurance, for example on the basis of a leasing contract. Cost support cannot support non-essential costs that are non-flexible in relation to business volume. Insurance costs related to the company’s property, such as insurance for office or warehouse space, can also be considered.

The assessment that is based on inflexibility also makes it possible to support vehicle-related maintenance costs where maintenance has been necessary for the conduct of the company’s business and it has not been reasonably possible to defer maintenance to a later date. An expense for a support period based on a maintenance contract can also be considered as an inflexible expense. Inspection costs for the support period are also eligible.

Taxi drivers can also incur inflexible costs from taxi brokerage companies. In principle, fuel costs cannot be taken into account in cost support, as material costs are not in principle supported by cost support. As a result, it is also not possible to consider the purchase of new tires, for example, as a necessary expense for the support period within the meaning of the law. However, it is possible to accept a portion of fuel costs that is not flexible: “You have to move from taxi stand to taxi stand, whether there are customers or not”.

Yes. Some of the costs and salary costs of the support period can be cut off, so there is a maximum limit for them. When granting cost support, other costs and salary costs for the support period are taken into account on a monthly basis, up to a total amount corresponding to the average monthly turnover of the company in the comparison period.

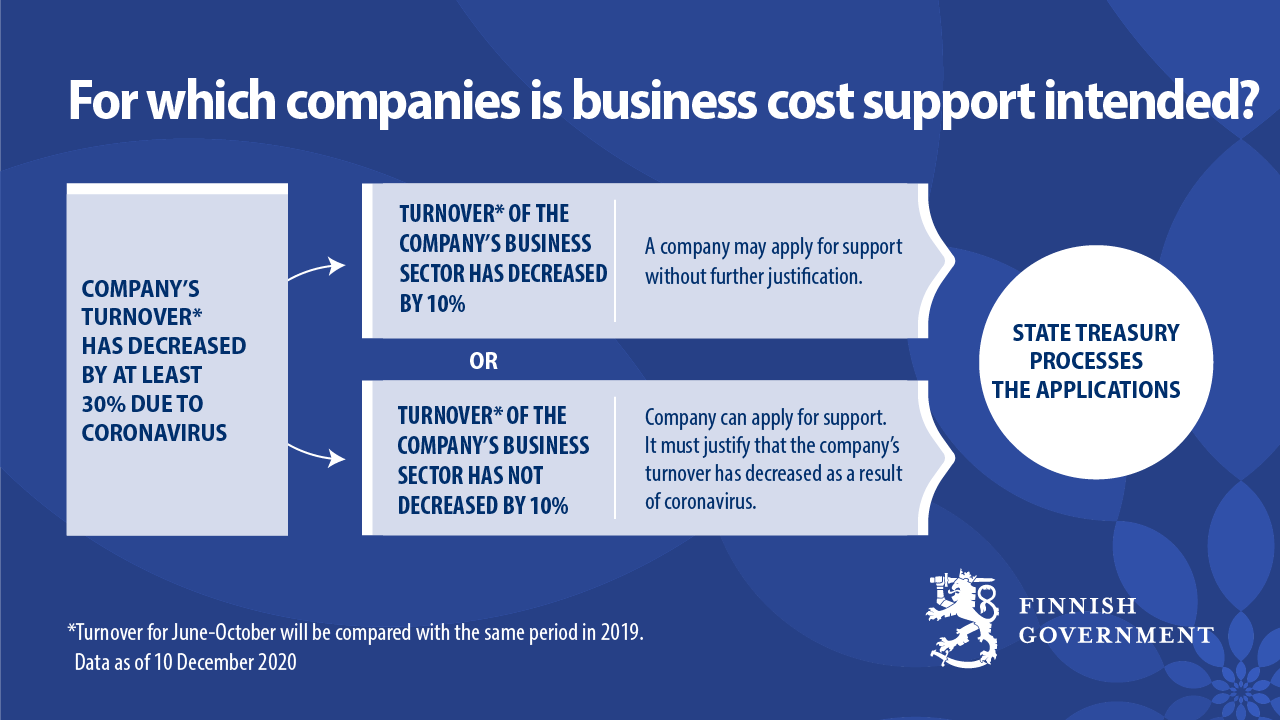

What is the sector limit like in the second round of cost support?

All businesses as well as foundations and associations with business activities can apply for cost support. Cost support may be granted to companies whose main sector was within the scope of the support on 1 June 2020. These sectors eligible for the cost support will be determined in a Government Decree on criteria laid down in the Cost Support Act. Limiting the eligible sectors is one way of targeting the cost support specifically at those companies which are adversely affected by the coronavirus pandemic. The list of eligible sectors>

Even if the company’s main sector is not eligible under the Government Decree, cost support may be granted to it on discretionary grounds. In this case, the company must separately prove in its application that the reduction in its turnover has resulted from particularly weighty reasons associated with the pandemic. For example, the impacts of regulations issued or restrictions imposed by the authorities can be regarded as criteria for granting discretionary support.

Please note that, in order to be eligible, the company must also meet the other criteria for receiving support.

Cost support cannot be granted to primary production in agriculture, fisheries and the aquaculture sector, however. These sectors are not eligible for support even on discretionary criteria, as separate State aid rules within the remit of the Ministry of Agriculture and Forestry are applied to them.

Is the previous Business Cost Support (Kustannustuki 1) paid in June 2020 included when calculating the company’s turnover?

Subsidies and aid granted to a company do not have an effect on the turnover data. The Business Cost Support is primarily determined on the basis of the VAT data for both the support period and the reference period, which the company has provided to the Tax Administration in the form of VAT returns. According to the instructions of the Tax Administration, subsidies and grants are not included in the VAT criterion when they are not directly connected to the price of the goods or services (ALV 79 §:n 1 momentti).

Is it possible to verify the decline in revenue by other means than through VAT returns submitted to the Tax Administration?

The Business Cost Support is primarily confirmed on the basis of VAT returns submitted to the Tax Administration. If the company’s business is wholly or partly non-VAT sales, the company shall provide the sales data of the support period and the reference period in the application. In case a company does not apply the monthly VAT return procedure, it will have to verify its turnover in another way. If a company justifiably (for example, as evidenced by accounting) proves in another way than through the Tax Administration Register that a decline of more than 30% in turnover has occured, the State Treasury may also consider such account when determining Business cost Support.

Are associations eligible for this support?

Yes. In addition to companies, the Act allows foundations and associations that conduct business to apply for the support.

What should I take into account when applying for cost support for my association?

Cost support may be granted also to associations and foundations that have business operations. That means you can apply for cost support for your association or foundation that has economic activities! If the same operator carries out both economic and non-economic (non-profit) activities, it is considered to be eligible for cost support only for its economic activities. Economic activities include all activities in which goods or services are offered on the market also to those who are not members. On the other hand, it is irrelevant from the point of view of State aid and business subsidies whether or not the activities aim to make a profit.

In particular, associations and foundations that carry out both economic and non-economic activities must be able to provide sufficient information in their aid applications, for example through their differentiated accounts, which share of the activities is related to economic activities. The payroll costs and other expenses used as criteria for determining the cost support may also be taken into account only for economic activities, so the organisation or foundation must also present a sufficient account of costs related to the financial activities of the association or foundation in the cost support application.

Associations and foundations are otherwise subject to exactly the same conditions for granting cost support as companies. For more information on the general prerequisites for granting cost support, visit: https://www.valtiokonttori.fi/en/service/business-cost-support/#general-information-on-support_what-is-eligibility-for-the-support-based-on. In addition, before submitting an application for cost support, you should also familiarise yourself with what the law says about the obstacles to granting cost support, which you can read about here: https://www.valtiokonttori.fi/en/service/business-cost-support/#general-information-on-support_general-conditions-for-granting-cost-support-and-obstacles-to-granting-the-support. It should therefore be noted that the association or foundation must also be entered in the prepayment register in order to be able to receive cost support. However, inclusion in the VAT register is not a prerequisite for granting the support. The association can voluntarily apply to the prepayment and VAT registers even if it does not engage in taxable business activities. In this case, the association’s economic activities are considered, in principle, to be the activities subject to VAT.

The Chair of an association registered in the Finnish Register of Associations may fill in an application for support in the e-services on behalf of the association. In addition to the application, the association must submit additional information showing that the Chair has the right to sign papers on behalf of the association alone or with authorisation by the signatory to submit the application (extract from the Register of Associations/rules/extract from minutes/power of attorney).

Can a new company apply for support?

Yes, if the company was established by 29.2.2020.

The granting of cost support requires that the company’s turnover for the support period has decreased by more than 30% compared to the comparison period. If the company was established on or after 1 May 2019, the company’s comparison period is 1.1. – 29.2.2020. If the company was established on or after 1.3.2020, the turnover for the comparison period cannot be determined for the company and the company is therefore not eligible for cost support.

Can a company apply for Cost Support if it was founded after February 2020?

The decrease in turnover of a new company founded after February cannot be compared with the comparison period of Cost Support (June-October 2019 or January-February 2020), as the company did not exist at the time of the comparison period. Therefore, the amount of Cost Support cannot be determined and the support criteria are not met.

Are sole entrepreneurs eligible?

All companies, foundations and associations that conduct business activities are eligible for the cost support. The size or type of the company has not been restricted. Sole entrepreneurs are eligible for the cost support if all conditions determined in the Act are met. The State Treasury receives salary information directly from the Incomes Register which will be the basis of salary costs for calculating the amount of support payable.

When have eligible costs been incurred? In the sphere of event industry, costs are usually incurred long before the event itself. Costs may be incurred throughout the year (e.g. festivals and fairs). Are the costs incurred outside the cost support period taken into account when assessing eligibility? If so, how does one prove at which point of time these costs have incurred?

According to Article 4 (1) (4) of the Law on fixed-term Business Cost Support, the criteria for determining Cost Support may include non-flexible operating costs and losses duly justified by the company during the grant period which are definitive and for which no cost support has previously been granted. Only costs for the support period (1.6.-31.10.2020) can be supported with Cost Support. Expenditure incurred outside the aid period is therefore in principle ineligible. However, it is possible to include, for example, advance payments for venue and equipment related to an event during the grant period (1 June to 31 October 2020) and subsequently canceled, if the advance payments have been final for the company and it is therefore not possible to obtain refunds or credits elsewhere.

In the event industry, there are not necessarily “traditional” fixed costs. There can be purchase service costs such as the use of expert services instead (e.g. attaching a freelancer to a project as a producer). Is such an expense accepted?

In the cost support criteria there is a definition of non-flexible costs that includes hired labour costs that correspond to the work tasks carried out by the company’s own staff and are necessary for maintaining the company’s business or business readiness. For example, a producer hired for a project during support period (1.6. – 31.10.2020) could be considered a necessary hired labour cost at discretion.

Non-flexible business costs, which are equivalent to the activities performed by their own staff and which are necessary to maintain business or business readiness, may also be considered as inflexible business costs included in the cost base. On the basis of company-specific considerations, for example, the costs of a producer attached to a project for the support period (1.6.-31.10.2020) could be considered necessary labor costs.

My company applies the marginal tax procedure in its operations – how do I report turnover data to the State Treasury?

For example, in the trade of second-hand goods, such as car dealerships, and for travel agents, there may be sales subject to marginal taxation. If the company applies the marginal taxation procedure in its operations, the company may notify the State Treasury of all its turnover data for the comparison period and the support period using the application form. In such a case, the company will use the application form to indicate both its sales subject to VAT and its sales subject to marginal taxation.

Applying for cost support

Where can I apply for support?

Companies apply for support from the State Treasury via an electronic application form.

How do I apply for support?

Applications are made online via the electronic application form >

Will I need a consultant to assist me in applying for the support?

The State Treasury aims to make the application process as easy for applicants as possible. The application for cost support has been tested on a customer panel to ensure clarity, and it has received good feedback.

Are supporting documents for inflexible costs required as an annex to the application?

Annexes cannot be submitted with the application. However, the State Treasury may ask the company to provide annexes separately. Receipts must be kept in accordance with the Accounting Act.

Is a statutory auditor’s report required for applying the support?

In principle, the statutory auditor’s report is not required. The State Treasury receives the necessary information for granting support from the application form and from the information provided by other authorities. If necessary, the State Treasury may request the company to submit an auditor’s statement or other report, for example, to determine the company’s financial situation.

Where can I get help for the application process?

The State Treasury has launched a phone service for entrepreneurs applying for the cost support. The phone service can help with filling the application and answering questions. The cost support service phone is open from 1 July on weekdays between 9-15 o’clock, tel. 0295 50 3050.

Can I send the application for cost support on paper if the e-service does not work?

It is not recommended to send the application on paper if the e-service is temporarily out of order; instead, you should wait until it is working again. The e-service is the simplest way to apply for the support, and it also enables the quick processing of the support application.

You can also send the application in PDF form if all persons in the company with the right to sign are foreign citizens and cannot authorize a Finnish person to apply. The PDF application can be ordered from the State Treasury applicationform.costsupport(at)statetreasury.fi.

Can I send an application if I don’t have an online bank ID?

You can also send the application in PDF form if the applicant is unable to use online identification to log into the e-service. Order the PDF application from: applicationform.costsupport(at)statetreasury.fi.

Can I use Katso identification to log into the application form or is it only possible with Suomi.fi identification?

Katso identification is not in use.

The service requires Suomi.fi authorisation for using the service as a business. You can find more information about online identification as a company here.

A person with the right to sign for the company can also electronically authorise another natural person to apply for the cost support on the Suomi.fi Mandates service by selecting the “Yritysrahoituksen hakeminen” (“Application for corporate funding”) mandate.

How can the support be applied for a association or for a foundation?

The chairman of the association, who is entered as a chairman in the Finnish Register of Associations, may fill in the application for Cost Support on behalf of the association in e-service. In addition to the application, an association must send evidence via a supplementary information notice that the chairman has the right to sign for association alone or is authorized by the signatories to send the application (association register / rules / minutes / power of attorney).

In the case of foundations, the application should be sent as a paper application if the authorization rights are not already defined. The PDF application can be ordered from the State Treasury applicationform.costsupport(at)statetreasury.fi.

Schedule

When will the second round of application begin?

The second round of application for cost support will begin on 21 December 2020 and end on 26 February 2021 at 16:15.

Do I need to make sure I apply as fast as possible? Is the support limited to just the first applicants?

No. Support will be available for those who fulfil the conditions determined in the Act.

When will I see the granted support on my bank account?

The State Treasury will aim to process the applications as fast as possible. Any support granted will be paid onto the bank account you have provided to the Tax Authority and should be available within three banking days.

Ask about cost support

Do you have any questions about business cost support that relate to the second round of applications? You can ask us via the links below. We will provide our responses to your questions on this page.