Central government finances describe the amounts and structures of the central government’s revenues and expenditures. The central government receives revenue from the taxes and fees it collects, as well as from the returns on the shares it owns. The majority of state expenditure is allocated to the central government’s statutory tasks. When the central government’s expenditures exceed its revenues, it must cover the difference by borrowing the funds it needs.

It should be noted that different parties may define central government finances in slightly different ways. Here, the term refers to the revenue and expenditure recorded in the budget, and it also encompasses all state-owned funds not included in the budget. The information on this page is based on the central government’s centralised accounting.

A large number of specialists from different agencies are involved in central government finances:

- Parliament approves the state budget and supervises central government finances. Parliament also decides on taxation, expenditure, and economic policy.

- The Ministry of Finance is responsible for a number of areas, such as the State Budget Act and the State Budget Decree, as well as for the preparation of the state budget and group policies.

- The State Treasury steers the central government’s financial administration and payment transactions. The State Treasury is also responsible for managing the central government’s centralised accounting and preparing the annual proposal for the final central government accounts for the Ministry of Finance.

- The other ministries are responsible for their respective administrative branches and their performance-related guidance. The ministries produce data for the Ministry of Finance and participate in the preparation of the budget.

- The National Audit Office of Finland (NAOF) supervises the use and administration of state funds. It audits the activities of the ministries and agencies and reports on its observations to Parliament. The NAOF is responsible for ensuring that all state funds are used efficiently and lawfully.

-

Central government finances are part of public finances

-

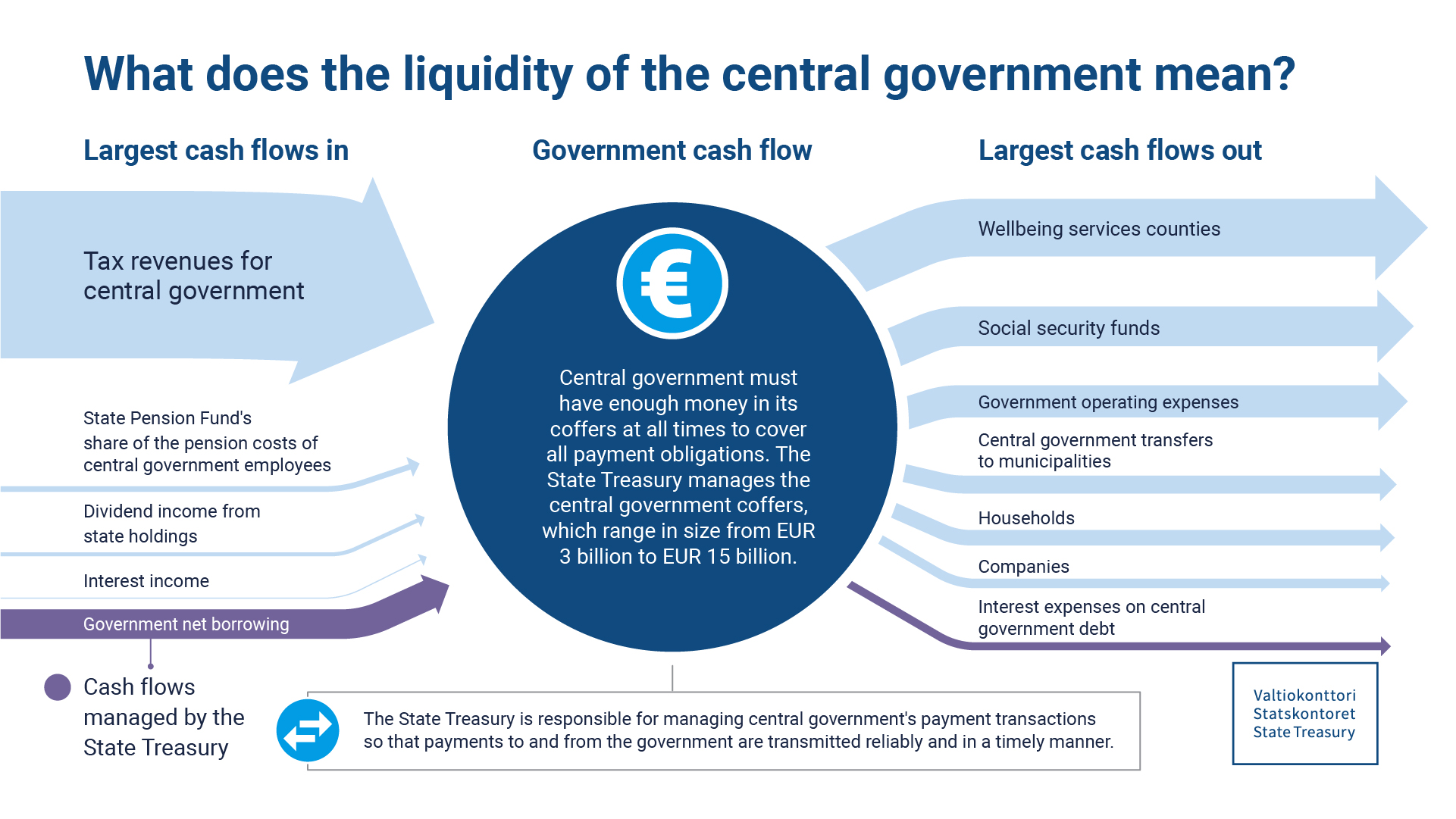

The State Treasury manages the central government’s liquidity

-

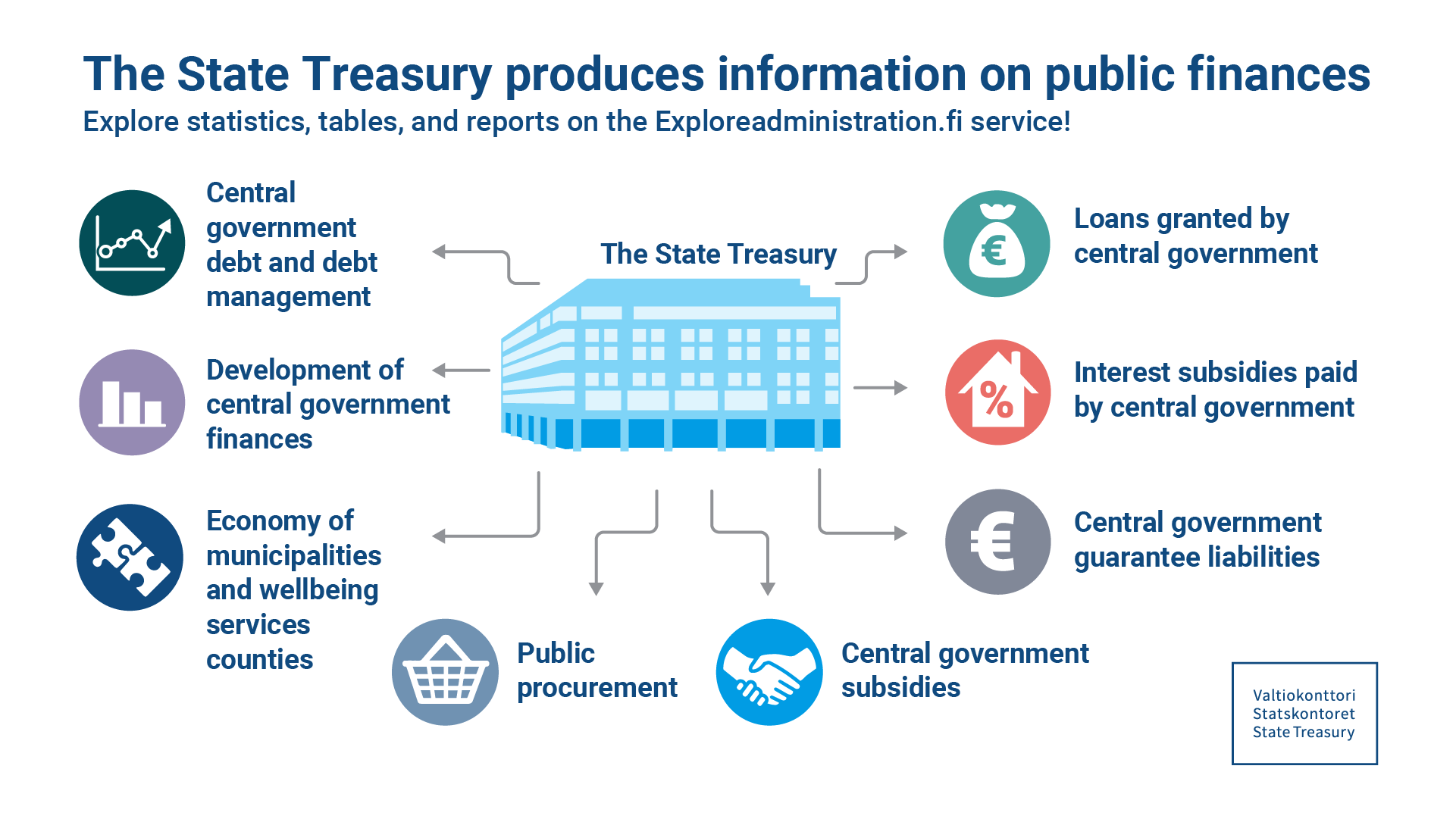

The State Treasury is responsible for reporting on central government finances

-

The State Treasury’s other tasks as part of central government finances

-

Contact information