This is a Services page for the fixed-term support for business costs for companies. The page consists of four tabs. The General information about the support tab has basic information on the service. We explain how to apply for support in more detail on the Application instructions tab. You can log in to the e-services on the Support application tab. On the Counter tab you can calculate indicative if your company is entitled to receive cost support. The actual support needs to be applied separately via the e-services.

The application period for the first round of cost support has expired at 4:15 pm on August 31, 2020.

The second round of applications is being prepared, the service page of the second round of applications is coming soon.

Instructions for the claim for correction

If you are dissatisfied with the decision from the State Treasury, you can require a correction. The instructions for the claim for correction are provided to you as an attachment with the decision. The claim for correction with the attachments shall be submitted to the Treasury during office hours (by 16:15 p.m.) within thirty (30) days from the date of notification of the decision. If the decision has been sent electronically, the notice is considered to have occurred on the third (3) day after the message is sent, unless otherwise shown.

The claim for correction should be sent to the State Treasury by email. Guidelines for sending classified email can be found at https://turvaviesti.valtiokonttori.fi/. Alternatively, a claim for correction may also be submitted to the State Treasury in person, by means of an agent or by mail.

The State Treasury’s contact details are:

Classified Email Service: https://turvaviesti.valtiokonttori.fi/

Email: oikaisuvaatimus.kustannustuki@valtiokonttori.fi-

What is it about?

The Finnish Government has decided to introduce a new form of support intended to cover the costs of businesses that have experienced a marked decrease in turnover due to the coronavirus and have costs that are difficult to adjust.

According to the bill, the aim of the support for business costs is to reduce the number of companies facing bankruptcy by ensuring the continuity of business activities and maintaining the financial production capacity.

The support will be granted by the State Treasury.

-

For whom is the support intended?

The support is intended for businesses that have experienced a marked decrease in turnover due to the coronavirus and have costs that are difficult to adjust.

In the model selected when the bill was drafted, a turnover decrease of at least 10% has occurred in the company’s sector compared to the comparison period. If the company operated in such a sector, it would also be required that the company’s own turnover had decreased by at least 30% from the comparison period.

Sectors

The sectors within the scope of support are specified separately by a government decree.

-

What is eligibility for the support based on?

Receiving cost support is based on the act and the related decree. The bill was drafted by the Ministry of Economic Affairs and Employment and the Ministry of Finance, and the law came into effect on the 1st of July 2020.

The cost support can be applied from State Treasury 7.7.-31.8.2020. The application period ends on 31.8.2020 at 16.15.

-

What are the conditions of eligibility for the support?

According to the bill, cost support is intended for companies that meet the following conditions:

- The company’s sector is within the scope of support. See which sectors are covered by the support >

- The company’s own turnover has decreased by more than 30% from the comparison period.

- The company has payroll costs and fixed costs that are difficult to adjust.

In addition to companies, foundations and associations that do business can apply for the support according to the bill.

According to the law, no support can be granted if the company’s total turnover for the entire refrerence period is less than 20,000 euros.

According to the law, no support can be granted if the amount of support to be paid is less than 2,000 euros.

If the company’s sector is not within the scope of support, the company can only be granted the support on particularly serious grounds. The conditions will be specified during the subsequent preparation of the act.

-

What is the turnover compared to, and what is the comparison period?

According to the bill, the comparison period for the turnover is the average of the company’s sales from March to June 2019. If the company was established on 1 March 2019 or later, the sales of the comparison period are the average sales of January and February 2020. The turnover decrease is determined based on the value-added tax returns submitted to the Tax Administration, or if these are not available, according to the company’s own report. See also: How much support can I get?

-

How do I apply for the support?

The application site for the cost support is open for the period of the 7th of July until 31st of August.

The application period ends on 31.8.2020 at 16.15.

The support can be applied for via the State Treasury’s e-services. Please begin by reading the application instructions published on the Application instructions tab.

-

How much support can I get?

According to the act, the support granted to the company must exceed €2,000. The maximum amount of support is €500,000 per company.

The support is based on information on the company’s turnover during the comparison period in addition to the turnover of the support period, the fixed costs of the support period reported by the company as well as payroll costs. The sales information for April 2020 that is the basis for support as well as the turnover information on the comparison period are primarily obtained from the information provided by the Tax Administration to the State Treasury. The State Treasury obtains the payroll costs of the company’s employees paid during the support period in accordance with the information in the Incomes Register.

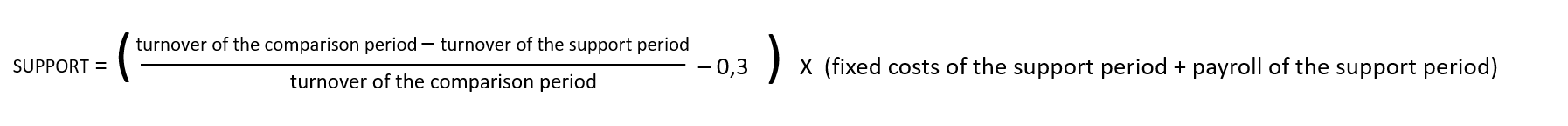

Formula for calculating the support:

Explanations of the formula:

Turnover of the comparison period = The average of the company’s sales from March to June 2019. If the company was established on or after 1.3.2019, the sales of the comparison period are the average sales of January and February 2020.

Turnover of the support period = Turnover of the support period is the company’s turnover in April 2020 OR, if the company demands it, the average monthly turnover during the support period from 1 April to 31 May 2020.

Fixed costs of the support period = Fixed costs reported by the company during the support period (2 months).

Payroll of the support period = Sum of the wages and salaries paid by the company according to the Incomes Register during the support period (2 months).

0.3 = A deductible of 30% of the reduction in sales.

-

Effect of other types of support on cost support

When cost support is granted or recovered, the other types of support received by the company are taken into account, i.e. consolidated.

When granting cost support, the following are taken into account as deductions:

- support for sole entrepreneurs granted by a municipality after 1 April 2020 and other forms of support intended to mitigate the effects of the coronavirus pandemic,

- 70% of the support granted by the ELY Centre from 7 April to 31 December 2020, intended for the analysis of the market and production disruption due to the coronavirus pandemic as well as development measures,

- 70% of the support granted by Business Finland from 19 March to 31 December 2020, intended for preliminary studies related to the market and production disruption due to the coronavirus pandemic as well as development measures,

- support granted under the Act on Supporting the Re-employment by Companies in the Catering Industry and Compensation for the Restrictions of Activity (403/2020), as well as

- support other than the support prescribed for mitigating the effects of the coronavirus pandemic referred to in sections 1—4 and allocated for the purpose in the state budget, as well as insurance compensation related to the coronavirus pandemic.

The State Treasury has the right to check the accuracy of the information and costs stated in the application later. Subsidy offences are provided for in chapter 29, sections 5–7, 7a and 8 of the Criminal Code (39/1889).

-

General conditions for granting cost support and obstacles to granting the support

According to the bill, support will not be granted in the following situations:

- The company’s turnover of the whole comparison period is in total less than €20,000.

- The support to be paid would be less than €2,000.

- The company is not registered in the prepayment register.

- The company has neglected to fulfil the reporting obligation concerning taxation.

- The company has tax debt information in the tax debt register.

- Enforcement is collecting unpaid taxes from the company.

- The company has been declared bankrupt, or it has a case pending at a court of law concerning the declaration of bankruptcy.

- The company was in difficulty before the coronavirus pandemic (31 December 2019). See the definition of a company in difficulty.

Definition of a company in difficulty in the EU Regulation:

A company in difficulty refers to a company in accordance with Article 2(18) of the General Block Exemption Regulation of the EU. According to the definition, a company is in difficulty, if

- more than half of its share capital has disappeared as a result of accumulated losses (limited liability companies),

- more than half of its capital as shown in the company accounts has disappeared as a result of accumulated losses (companies where at least some members have unlimited liability for the debt of the company),

- the company is subject to collective insolvency proceedings,

- the company has received rescue aid and has not yet reimbursed the loan or terminated the guarantee, or has received restructuring aid and is still subject to a restructuring plan,

- the company is not an SME, and for the past two years, its book debt to equity ratio has been greater than 7.5 and its EBITDA interest coverage ratio has been below 1.0. Only section c applies to SMEs less than 3 years old.

-

Do this before filling out the application

The application site for the cost support is open for the period of the 7th of July until 31st of August. The application period ends on 31.8.2020 at 16.15.

Before applying, check and take care of the following:

- Using Suomi.fi Authorisations, either an individual authorised to sign for the company or an authorised party may make the application. The applicant should check that any signatory matters are in order. If there are issues or matters requiring rectification in terms of the company’s signatory rights, they may be rectified by contacting The Finnish Patent and Registration Office >

- It is also worth checking that any measures required to permit a party to act on the company’s behalf have been taken care of in Suomi.fi. Authorisations required for representation on behalf of a company/association can be taken care of through the Suomi.fi Authorisations service. Support for business costs can be applied for with an authorisation under ‘Yritysrahoituksen hakeminen’ (‘Applying for company financing’). Suomi.fi Authorisations >

- In order to apply for support, the applicant must have a Business ID. For further information: Information system on businesses and organisations >

- Support for business costs may only be paid into accounts that the company has notified the Tax Administration of. Check the account number you have provided to the Tax Administration and provide a new number if necessary on the MyTax site >

- If a company that files their VAT return to the Tax Administration on a monthly basis wants to use the sales information for May in calculating the turnover of the support period, the application can be submitted only after the VAT return for May has been filed. File your VAT return as soon as possible to speed up the processing of your application.

-

NOTE: Tax information is updated in our systems after it has been processed by the Tax Administration. There are delays between the systems, which is why the May VAT returns will not be available to us until 22.7.

-

Application instructions

Detailed instructions for applying for cost support

Before applying for cost support, you should check that all the conditions for granting the support are met. In particular, the applicant company should ensure that the general conditions for the granting of cost support are met, as several rejections have been made due to these conditions.

- Company industry

Familiarize yourself with the industries that are eligible for cost support and make sure your business is covered. If the company’s business is not covered by the aid, the company can only be granted cost support for particularly serious reasons related to the COVID19 pandemic, as demonstrated by the company.

- The aid to be paid to the company is at least 2,000 euros

No cost support will be paid if the amount of support to be paid is less than 2 000 euros. You can use the cost support calculator to see how much support your business could receive.

- The company’s total turnover at the time of comparison is at least 20 000 euros

The aid cannot be granted if the company’s total turnover for the entire comparison period is less than 20 000 euros.

- Turnover drop of more than 30%

The terms of the aid also include that the company’s turnover during the aid period has fallen by more than 30% compared to the comparison period. If this condition is not met, no cost support can be granted.

- The company is not affected by any of the obstacles to granting cost support

Obstacles are provided for in section 6 of the Law on Temporary Cost Support for Companies (508/2020).

In addition, the aid cannot be granted to a company that was a firm in difficulty within the meaning of European Commission Regulation (EU No 651/2014) on 31 December 2019.

Other things to consider at the application stage:

- Fixed costs. According to the Cost Support Law, fixed costs include rental costs and other costs of own real estate, rental of equipment and objects, access rights and license fees. The statutory fixed costs should be declared in the application as accurately as possible by type of expenditure (not just the total amount), as this will facilitate the smooth processing of the application. There are examples of reimbursable fixed costs on the State Treasury’s website.

If necessary, the State Treasury will request additional information from the applicant. The State Treasury may grant cost support only in accordance with the criteria laid down by law. The company will be able to provide all the information needed to grant the aid on the application form. In addition, the State Treasury automatically receives information from other authorities, such as the Tax Administration, in order to grant aid. Applicants do not, in principle, have to submit additional information to the State Treasury. Applications are processed on the basis of the information provided by the company in its application and information received from other authorities.

-

Filling in an application as a signatory and Suomi.fi e-Authorizations

Filling in an application as a signatory

The application for the cost support can be filled in by a person who has the right to sign for the company. In addition, the application can be filled in by a person who has a role entered in the Trade Register, the Business Information System or the Register of Associations that entitles the person to represent.

Roles entered in the Trade Register that entitle a person to act on behalf of the company are:

- Managing Director

- Substitute Managing Director

- Trader

- Building Manager

- Building Manager in Charge

Roles entered in the Register of Associations that entitle a person to act on behalf of an association are:

- Another signatory, whose the right to represent the association alone has been entered in the register

Granting a mandate to a representative of the company

The company may also authorise another person to represent the company through Suomi.fi e-Authorizations (the link will open in a new browser tab.). Select the mandate “Applying for corporate financing”.

Parties who can grant mandates on behalf of a company are:

- private entrepreneur on behalf of their own company

- the managing director or substitute managing director of a company

- a signatory of a company who has been entered in the Trade Register and has the right to represent the company alone

- all the board members of the company, who have been entered in the Trade Register, together

- in accordance with the rule of representation entered into the Finnish Trade Register, the board chairperson and one board member together or two board members together

- a person to whom the company has given the right to grant mandates or a representative’s right to grant a mandate.

Parties with the right to grant mandates on behalf of a registered association are:

- the association’s chairperson, a member of the board or other signatory for whom the right to represent the association alone has been recorded in the Register of Associations

- a person to whom the association has given the right to grant mandates or a representative’s right to grant mandates.

Digital and population data services agency’s Customer service for organisations helps companies to use Suomi.fi e-Authorizations.

Call: +358 295 53 5115 -

Video instructions

-

Phone service

The cost support phone service is intended for entrepreneurs applying for cost support for companies. At the phone service, we will advise you on filling in the application and answer to your questions.

The cost support phone service serves from July 1 on weekdays from 9.00 to 15.00 at 0295 50 3050.

All calls are recorded.

The State Treasury does not charge additional fees or service charges for calls to 0295 numbers. Operators charge a standard mobile/service network fee for calls.

-

Recording from the Business cost support webinar (June 30, 2020)

In the webinar, the State Treasury experts will talk about cost support and how to apply for support. The webinar covers all the key issues about business cost support and answers the most frequently asked questions, such as the following:

- What kind of company can receive support?

- For what kind of costs can support be granted for?

- How to apply for support?

- Where can I get advice on how to apply for support?

-

Apply for support through e-services

The application site for the cost support is open for the period of the 7th of July until 31st of August.

The application period has ended on 31.8.2020 at 16.15.

Instructions for the claim for correction

If you are dissatisfied with the decision from the State Treasury, you can require a correction. The instructions for the claim for correction are provided to you as an attachment with the decision. The claim for correction with the attachments shall be submitted to the Treasury during office hours (by 16:15 p.m.) within thirty (30) days from the date of notification of the decision. If the decision has been sent electronically, the notice is considered to have occurred on the third (3) day after the message is sent, unless otherwise shown.

The claim for correction should be sent to the State Treasury by email. Guidelines for sending classified email can be found at https://turvaviesti.valtiokonttori.fi/. Alternatively, a claim for correction may also be submitted to the State Treasury in person, by means of an agent or by mail.

The State Treasury’s contact details are:

Classified Email Service: https://turvaviesti.valtiokonttori.fi/

Email: oikaisuvaatimus.kustannustuki@valtiokonttori.fi -

Legislation