From April 2021 onwards, the State will only accept e-invoices that are compliant with the European Standard. The objective of the change is to direct invoicing by companies and public administration into electronic form. What is an e-invoice that is compliant with the European Standard? What should an entrepreneur take into account when switching to e-invoicing that is compliant with the European Standard?

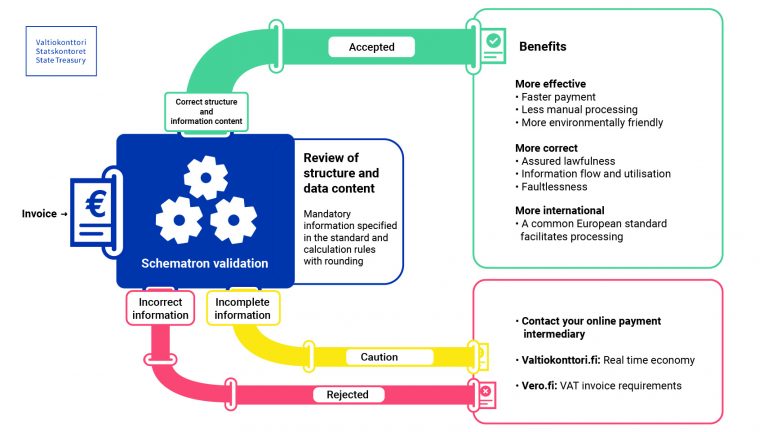

The purpose of the validation of e-invoices that are compliant with the European Standard is to improve the accuracy of the information contained in e-invoices. Checking and correcting incorrectly entered information takes up a lot of time in financial administration. Improving the accuracy of information will contribute to the automation of financial administration in both the private and public sectors.

Only e-invoices compliant with the European Standard are validated

The Electronic Invoicing for Contracting Entities and Traders Act (241/2019) is compliant with the eInvoicing Directive of the European Union (EU) and has entered into force on 1 April 2020. The rules for validating European Standard invoices are based on the EU Standard EU16931, known as the European Standard. Companies and traders are asked to switch to European Standard invoicing to ensure that invoices sent to the State from 1 April 2021 meet the European Standard requirements.

Under the Act, the recipient of an invoice has the right to receive an invoice from another company in the form of an electronic invoice as specified by law upon request. Invoices sent to the State from April 2021 onwards must comply with the European Standard. The Government has the capacity to send and receive e-invoices, the information content of which corresponds to the European Standard.

Transition to e-invoices that are compliant with the European Standard

E-invoicing operators will start validating e-invoices that are compliant with the European standard on 6 April 2021. Validation rules are strict. If the invoice does not pass the validation, it will not be delivered to the recipient at all. The invoice is rejected by the e-invoicing operator, and the invoice sender receives an error message. The invoice sender must correct the errors/shortcomings in the invoice and also check that the due date of the invoice corresponds to the agreed payment time when the invoice is sent again.

The most recent national electronic invoice format descriptions (Finvoice 3.0 and TEAPPSXML 3.0) are compliant with the European Standard.

If, for a justified reason, a company or a trader is unable to send an invoice in accordance with the European Standard within the required timeframe, a separate agreement on a transitional period for invoicing in accordance with the European Standard must already be made with the Agency in connection with the preparation of the order or contract.

Application instructions for public administration on the Government Electronic Invoicing Website >

Further information:

verkkolaskutus(at)valtiokonttori.fi

Website of the State Treasury when invoicing the State >

Questions and answers about e-invoicing

The State Treasury is preparing for the change and offers information on the European Standard and e-invoicing during March and April on their website and social media channels. Questions and answers regarding the change are published weekly, and the answers are collected on the State Treasury’s Real-time economy service page. You can also send a question that you would like to see answered to verkkolaskutus(at)valtiokonttori.fi.