Electronic invoicing is an excellent and fast way to deliver an invoice to a client. Digitalisation enables electronic invoice processing and improves preparedness for exceptional circumstances. Electronic invoicing is also a prerequisite for the automation of financial administration.

Electronic invoicing is an excellent and fast way to deliver an invoice to a client. Digitalisation enables electronic invoice processing and improves preparedness for exceptional circumstances. Electronic invoicing is also a prerequisite for the automation of financial administration.

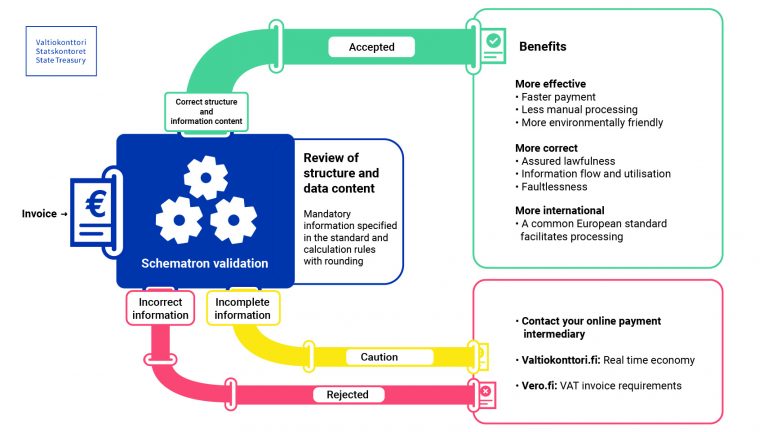

Electronic invoicing improves the profitability of business, which manifests as saved costs, for example. Excluding some exemptions, the central government has long been requiring its suppliers to submit electronic invoices. For the most part, the government processes electronic invoices automatically, which has increased the productivity of financial administration. This increase in productivity can also be achieved in the corporate world if invoices are delivered in a structured, electronically readable format.

Real-time economy, which includes electronic invoicing, electronic receipts and automation of financial administration processes, also supports preparedness for various exceptional circumstances.

“The government is never late on payment, especially when the invoices have been submitted as electronic invoices. Even if there are delays in the delivery of mail, electronic invoices are delivered as usual,” Payment Transactions Manager Keijo Kettunen from the State Treasury points out.

Real-time economy and structured information will revolutionise financial administration

The digitalisation of financial administration has taken great strides over the last few years. For example, by 2025 the government will switch to comprehensive use of the digital eKuitti, i.e. electronic receipts, which will largely determine which service providers can partner with the government as a result of various tender processes. The productivity potential is great. The adoption of electronic receipts and electronic invoicing is estimated to yield EUR 300 billion in savings annually within the European Union by streamlining and enhancing financial processes.

“This itself is a sufficient reason to speed up the adoption of structured information. Abandoning paper invoices will not only yield valuable benefits but also facilitate the everyday life of both companies and consumers. The largest savings will be achieved through reductions in distribution costs and manual ledger management. Reducing late payments will also reduce the costs of payment monitoring,” Kettunen says.

Electronic invoicing is a prerequisite for the automation of financial administration

According to the Government Programme, the government wants to make Finland a forerunner in real-time economy. In practice, this means, among other things, that the details of business transactions can be conveyed in an electronic format and in real time from one company to another and from companies to government agencies. In order for this exchange of information to be automatic, all receipts and invoices must be in an electronic format.

Investing in electronic government services also creates a basis for innovation in companies and reduces costs to companies. The automation of financial administration is also the aim of the Nordic Smart Government (NSG) project set up by the Nordic Business Registries, which expands the goals set by the government to apply to the Nordic level. The goal is to automate the flow of financial information between companies in the Nordic countries.

Further information and interview requests:

Payment Transactions Manager Keijo Kettunen, State Treasury, tel. +358 295 50 2408, keijo.kettunen[at]valtiokonttori.fi