The State Treasury’s proposal for the final central government accounts for 2021 has been signed and submitted to the Ministry of Finance. The final central government accounts are drawn up based on the central government’s on-budget entities.

The State Treasury’s proposal for the final central government accounts includes the central government’s income and expense account, balance sheet, budget realisation statement, cash flow statement and the appendices to the statements.

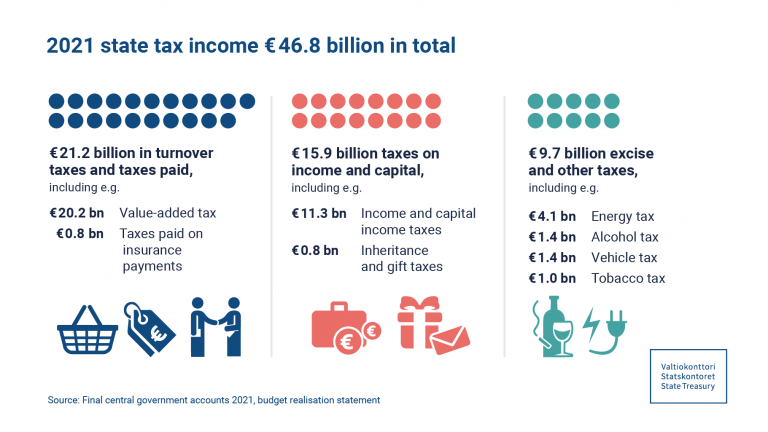

According to the central government’s income and expense account, the deficit for 2021 was EUR 6.3 billion. In 2020, the deficit amounted to EUR 12.7 billion. Compared to the previous year, income was 11.4 per cent higher and expenses were 1.5 per cent lower. The increase in income was mainly due to an increase in financial and tax revenues.

The main reason for the increase in tax revenue was economic recovery. In euro terms, income and capital income tax (approx. EUR 2.0 billion) and value added tax (approx. EUR 1.9 billion) increased the most. The increase in financial income is due to the increase in dividends received.

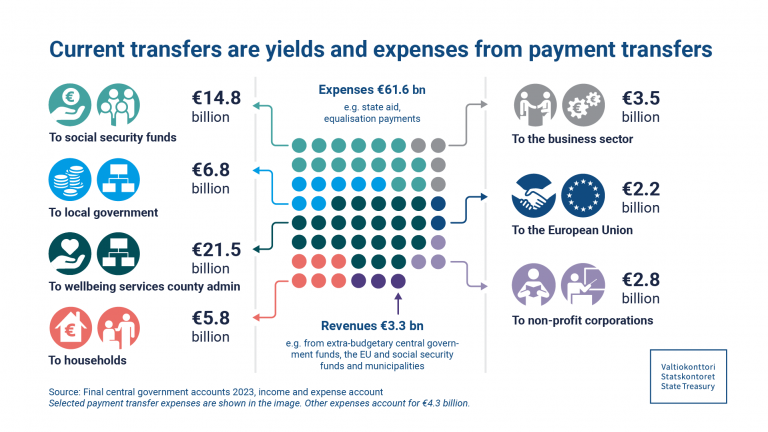

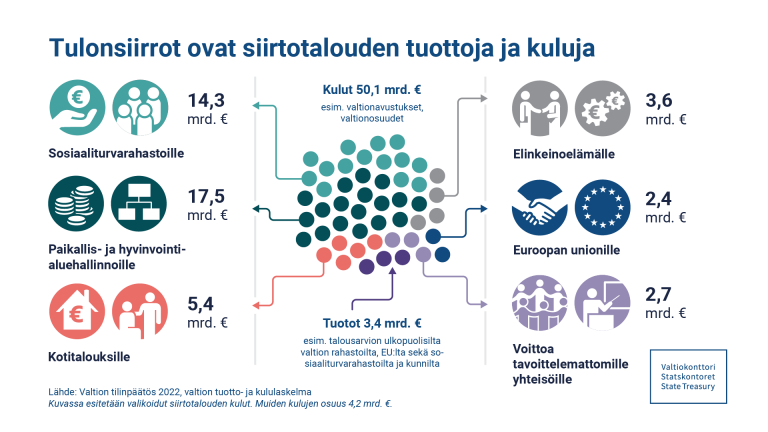

The share of payment transfer expenses in expenses was 80 per cent, totalling EUR 48.3 billion, which was approximately EUR 0.8 billion less than in the previous year.

The payment transfer expenses for local government (approx. EUR 14.3 billion) and social security funds (approx. EUR 14.5 billion) were the main items of the payment transfer expenses. There was a slight decrease in both of these compared to the previous year. The costs of the payment transfer for local government decreased by approximately EUR 0.6 billion, most of which is due to the decrease in central government transfers to local government. The payment transfer expenses for social security funds (a decrease of approx. EUR 0.5 billion) was subject to changes in several instalments, the largest of which were those arising from unemployment benefits and pensions. Subsidies paid to companies due to the coronavirus crisis increased the costs of the transfer economy by approximately EUR 0.1 billion.

The state balance sheet totalled EUR 61.5 billion, which was approximately 3 per cent lower than in the previous year. The biggest changes in the balance sheet were changes in central government debt and cash equivalents. Sufficient liquidity has been maintained even though the state’s cash reserves have been reduced.

The net increase in the shared central government debt of on-budget entities and the central government’s extra-budgetary funds was EUR 3.9 billion, with the total nominal value of the central government debt being EUR 128.7 billion and the market value being EUR 136.0 billion.

According to the central government’s budget realisation statement, the deficit for the financial year 2021 was EUR 5.3 billion, while the cumulative deficit at the end of the financial year was EUR 15.297 billion. Budget income totalled EUR 60.748 billion, including net borrowing of EUR 4.307 billion. Budget expenses were EUR 66.002 billion.

Budget realisation, income and expenses and balance >

Significant events after the financial year ended

On 24 February 2022, Russia attacked Ukraine. As a result of the attack, the EU and many other countries have imposed strong economic sanctions against Russia, which will also have an indirect impact on the Finnish economy. By the time the State Treasury’s proposal for the final central government accounts for 2021 was completed, the impact of the sanctions on the Finnish economy has not yet been possible to predict.

The State Treasury’s proposal for the final central government accounts for 2021 > (in Finnish)

More detailed breakdowns of the final central government accounts and accounting data are available via the reporting service maintained by the State Treasury at www.exploreadministration.fi. The page also includes links to other documents related to planning and monitoring.

The final central government accounts are attached to the government’s annual report, which is submitted to Parliament in May.

Further information:

Jaana Kuusisto, Government Controller, Ministry of Finance, tel. +358 (0)2955 30051, jaana.kuusisto(at)gov.fi

Sirpa Korkea-aho, Ministerial Adviser, Ministry of Finance, tel. +358 (0)2955 30252, sirpa.korkea-aho(at)gov.fi

Jaana Tiimonen, Accounting Manager, State Treasury, tel. +358 (0)2955 02261, kkp(at)valtiokonttori.fi