Every year by the end of February, government agencies and departments draw up the final central government accounts, which include the annual report, budget realisation statement, income and expense account, balance sheet and notes. The State Treasury compiles the account details of agencies and departments in the central government’s Central Bookkeeping and draws up the final central government accounts based on this data.

On-budget finances comprise the revenue estimates and appropriations decided for the central government budget by Parliament. The final central government accounts are prepared based on the central government’s on-budget finances data. They contain the budget realisation statement, income and expense account, balance sheet, financial statement and notes.

The visual representation is based on the calculations in the 2021 final central government accounts, and the review focuses on the central government’s on-budget finances. In the visual representation of the final accounts, the figures are rounded to the nearest EUR 0.1 billion. When using visual representations prepared by the State Treasury, the original source and the date of the version must always be listed. For example:

- © State Treasury (more precise expression of time)

- Includes / the image is based on materials of the State Treasury (more precise expression of time)

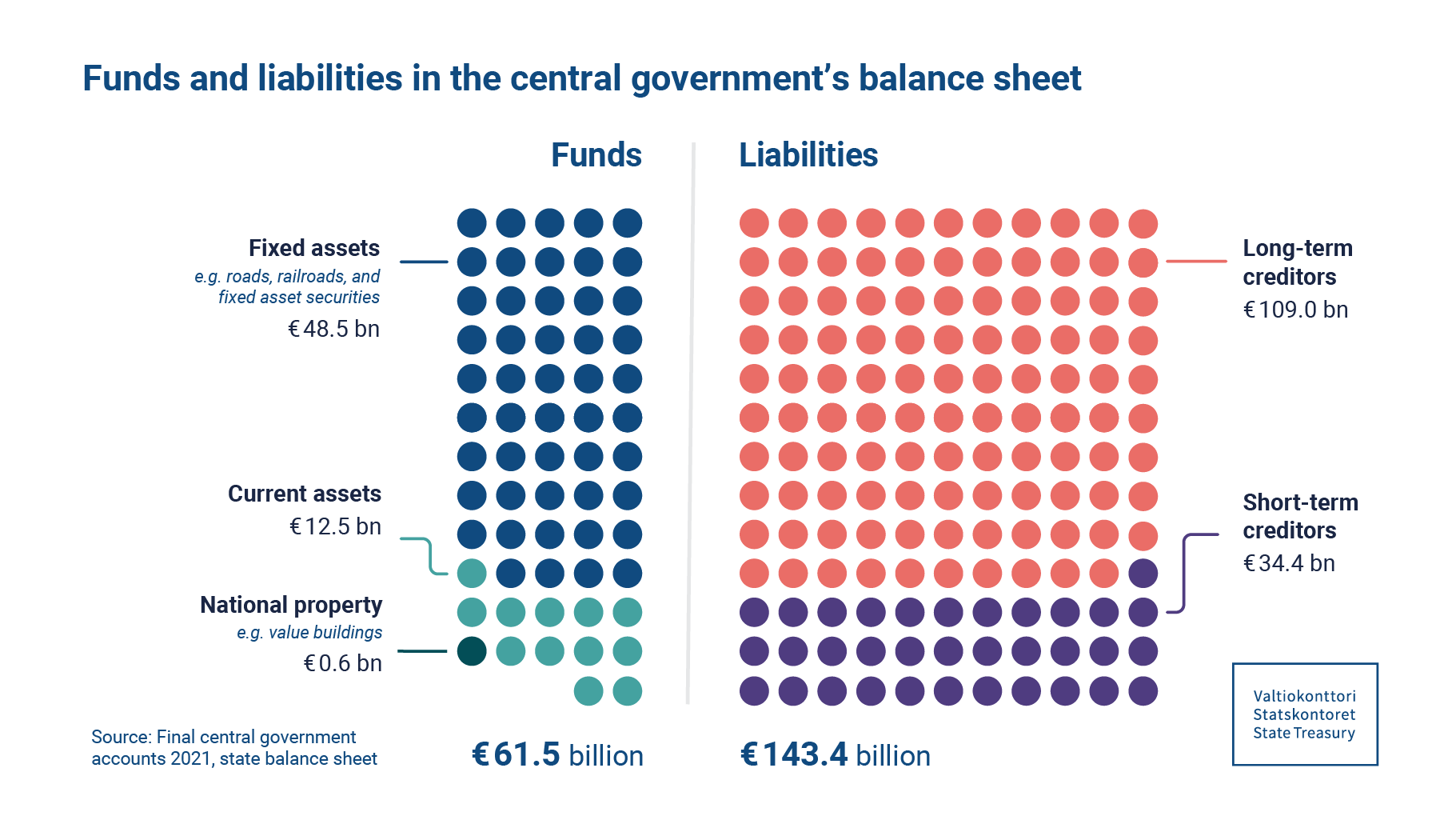

In 2021, the balance sheet total of central government finances of the Finnish government amounted to EUR 61.5 billion. This is about EUR 1.7 billion, or about 3 percent, lower than in the previous year. The biggest changes in the balance sheet were changes in central government debt and cash equivalents. According to the balance sheet, central government debt totalled EUR 131.2 billion at the end of 2021, compared with EUR 126.8 billion at the beginning of the same year. In addition to long-term creditors, government debt according to the balance sheet refers to short-term creditors, as well as to installments payable in the following financial year and short-term creditors denominated in euros.

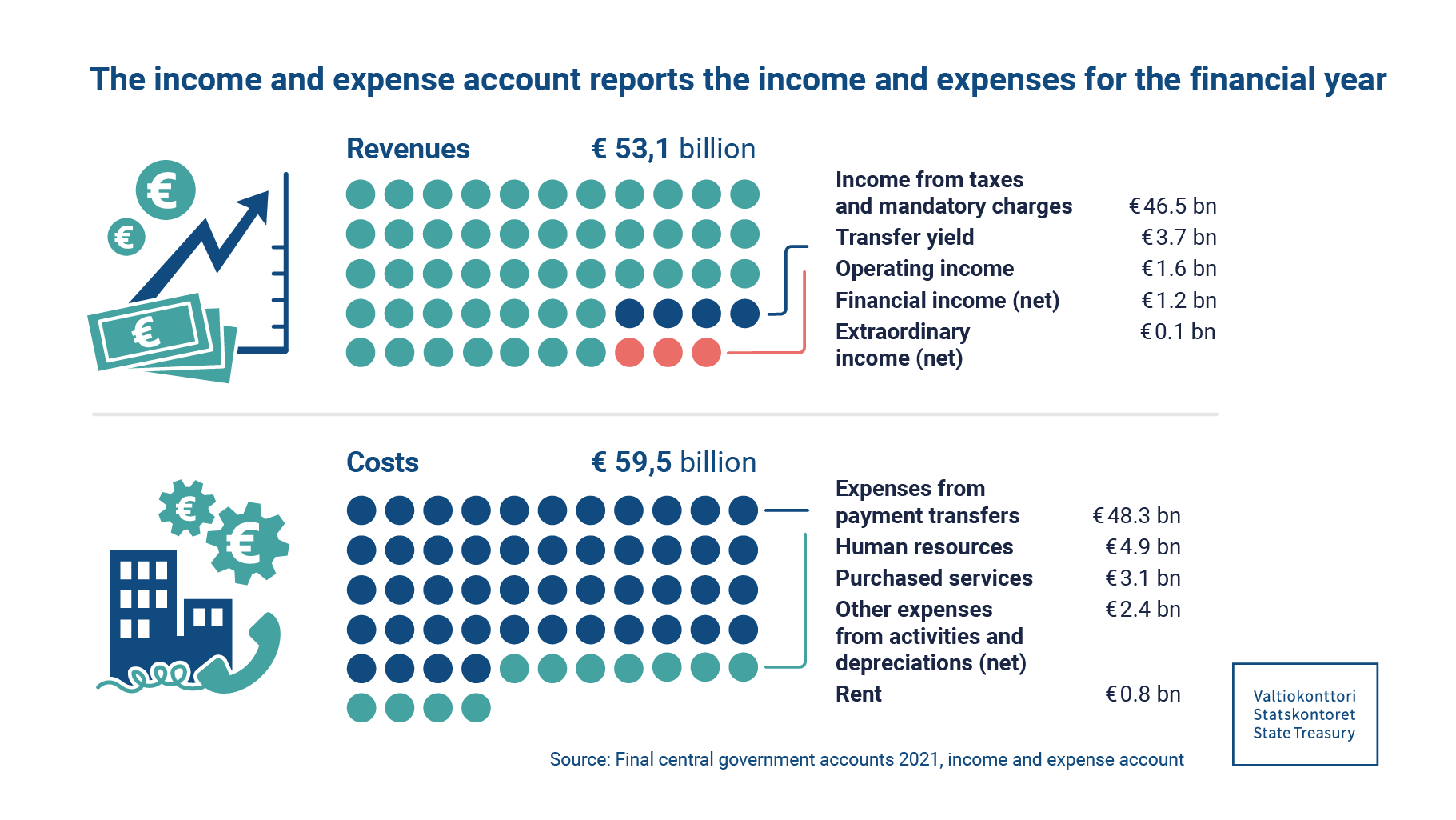

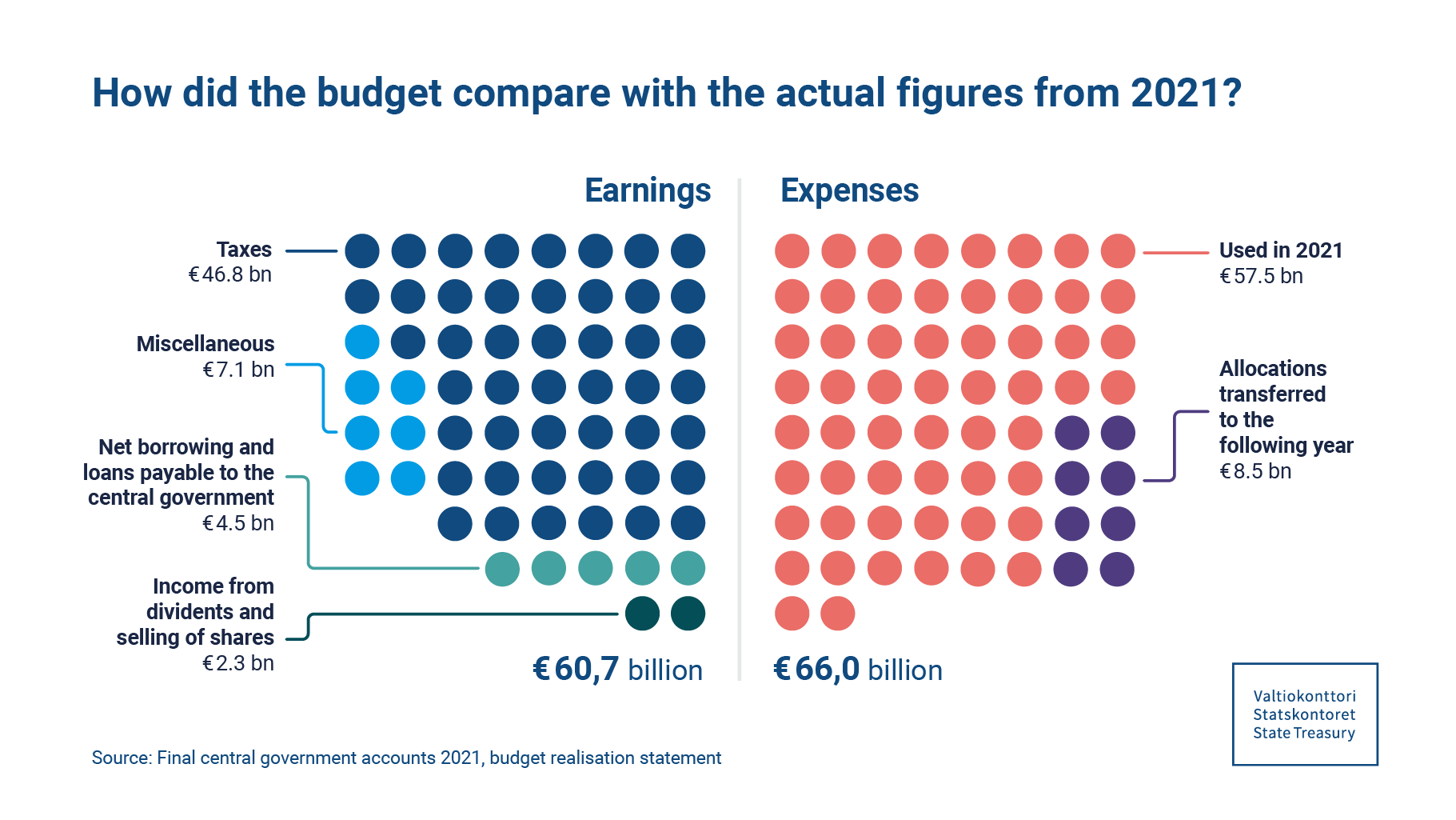

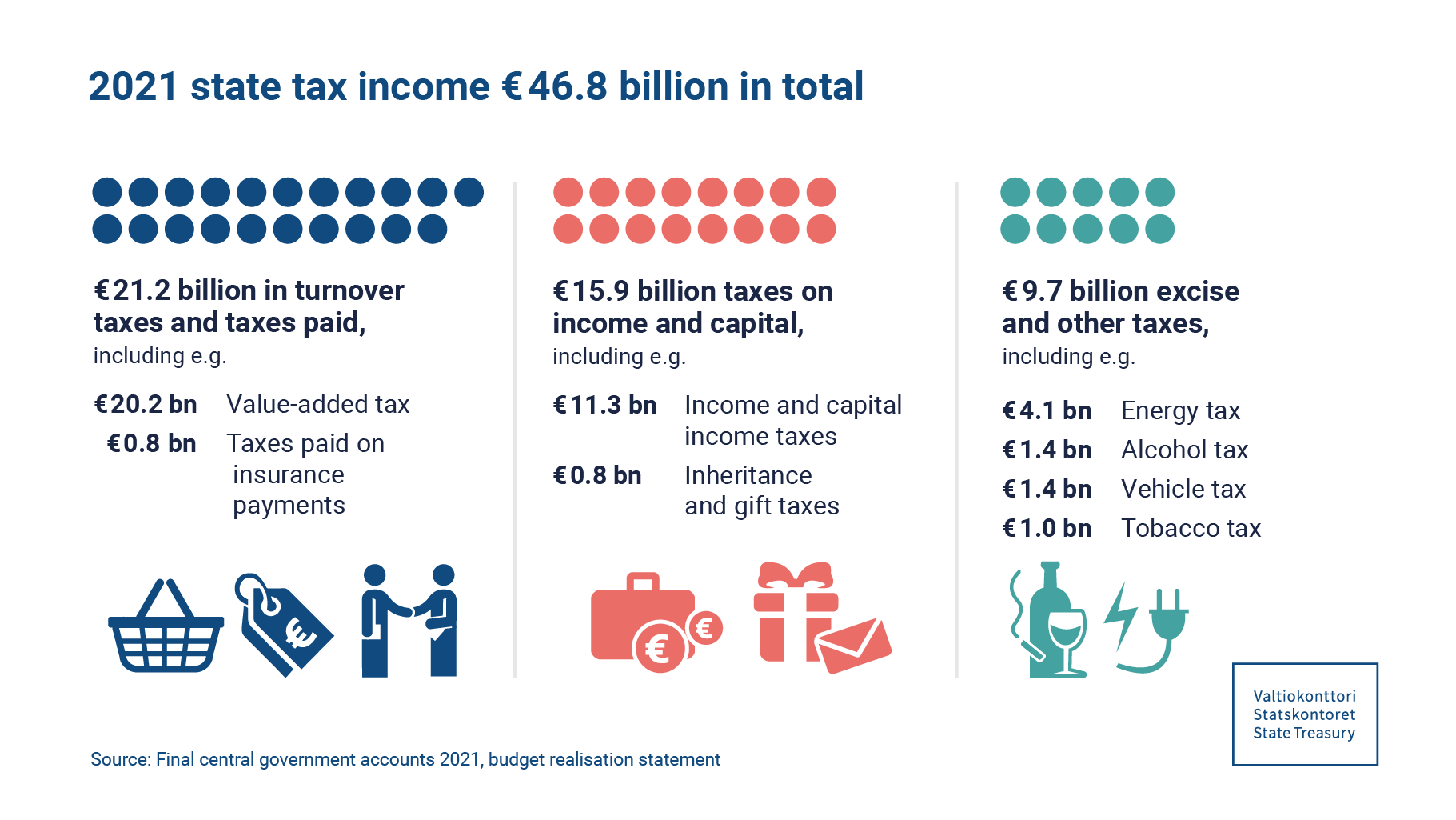

According to the central government’s income and expense account, the deficit for 2021 is EUR 6.3 billion, while the deficit for 2020 was EUR 12.7 billion. This change was particularly affected by the increase in tax revenue and financial revenue.

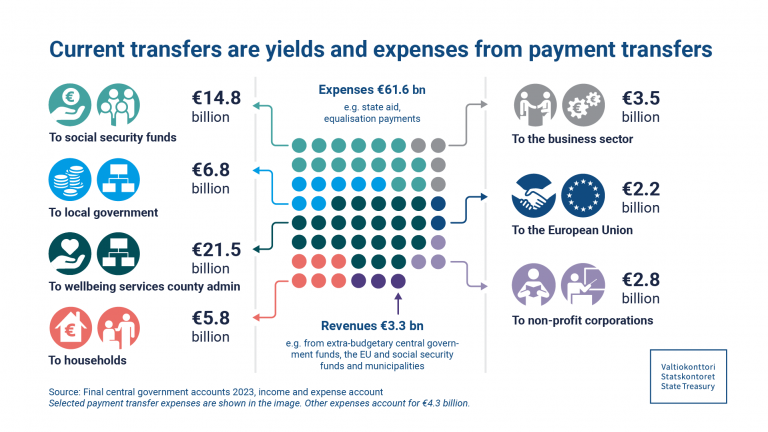

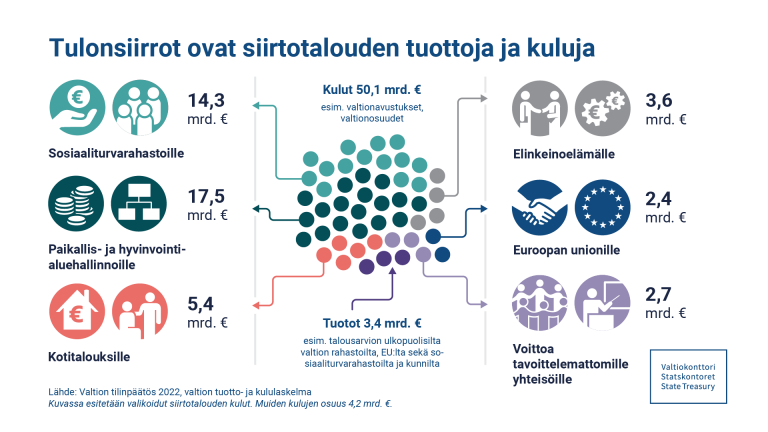

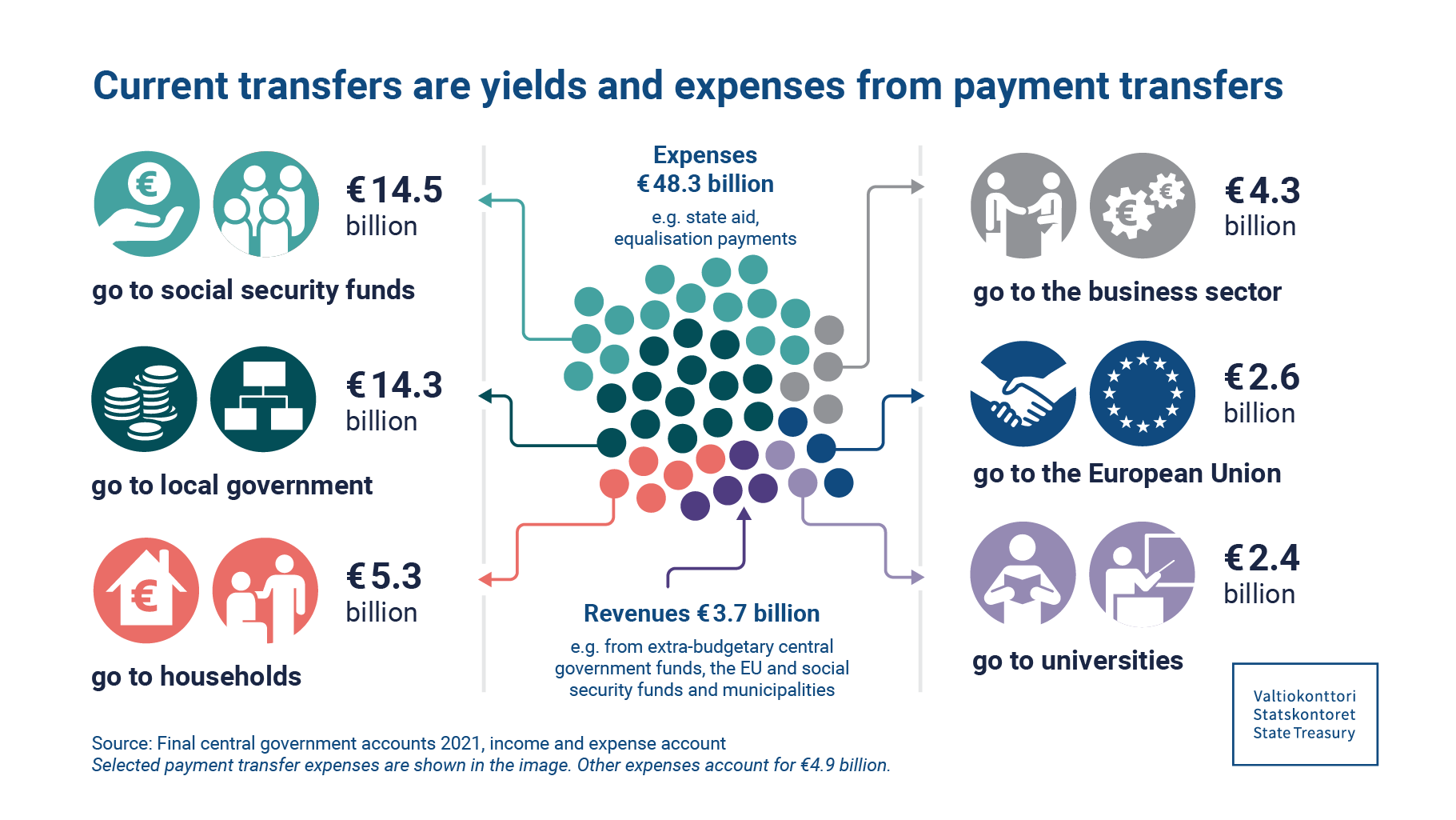

What are payment transfers?

Revenues and expenses from payment transfers do not involve a direct consideration. However, tax revenues are presented as separate revenues in the final accounts. Revenues from payment transfers include e.g. financial contributions received from European Union (EU) Structural Funds that are gross budgeted in the central government budget.

The central government transfers and grants paid to municipalities and social security funds fall under payment transfer expenses. The payment transfer expenses accounted for 80 percent of all expenses, which means a total of EUR 48.3 billion. This is about EUR 0.8 billion less than in the previous year.

The deficit of the budget realisation statement according to the state accounts for 2021 is EUR 5.3 billion. The deficit was affected by a decrease of EUR 7.9 billion in net borrowing compared to last year.

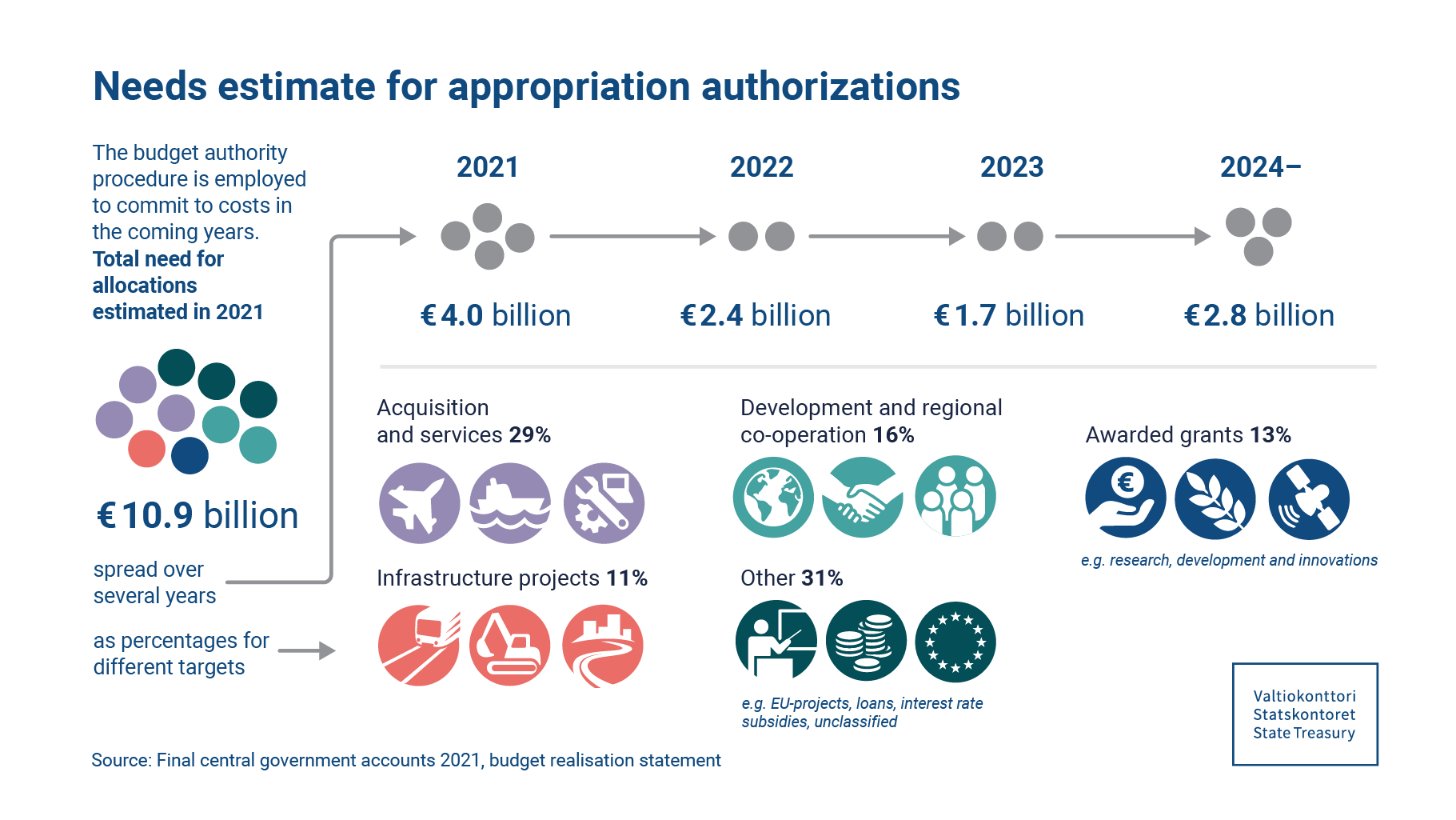

Monitoring of authorisations as part of the monitoring of budget realisation

In conjunction with the processing of the budget, Parliament can also grant an authorisation that is limited in terms of quantity and purpose of use for making agreements and commitments. The appropriations required for the expenses incurred from this are included in the budgets for later years either in full or for the missing parts. An authorisation can be used during the financial year for which it is granted in the financial year’s budget. The exercise of the authorisation shall mean the conclusion of agreements and commitments for which the authorisation has been granted in the budget.

The centralised monitoring of authorisations is carried out by the State Treasury. In addition to the needs for appropriations mentioned here, the central government also has needs for appropriations that arise from other commitments. These are described in e.g. Appendix 12 to the final central government accounts.

Parliament receives reports of the budget’s realisation

Operational and financial planning links the tasks and goals of the central government and ministries, as well as the operational tasks of government agencies, to each other. Each year in May, the Government submits the Government’s annual report to Parliament. It reports on Government activities, the management of central government finances and adherence to the budget. The report also includes descriptions of the performance of ministries, the final central government accounts and replies to parliamentary statements and position papers.

Further information:

Central Government Accounting, tel. + 358 (0)295 50 2000, kkp(at)valtiokonttori.fi