Real-time economy

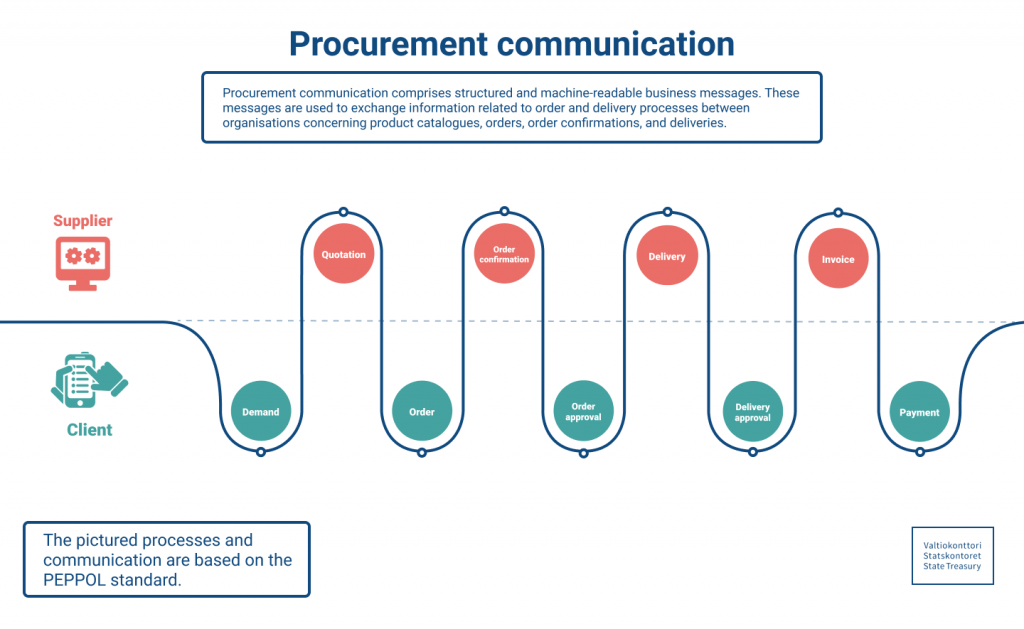

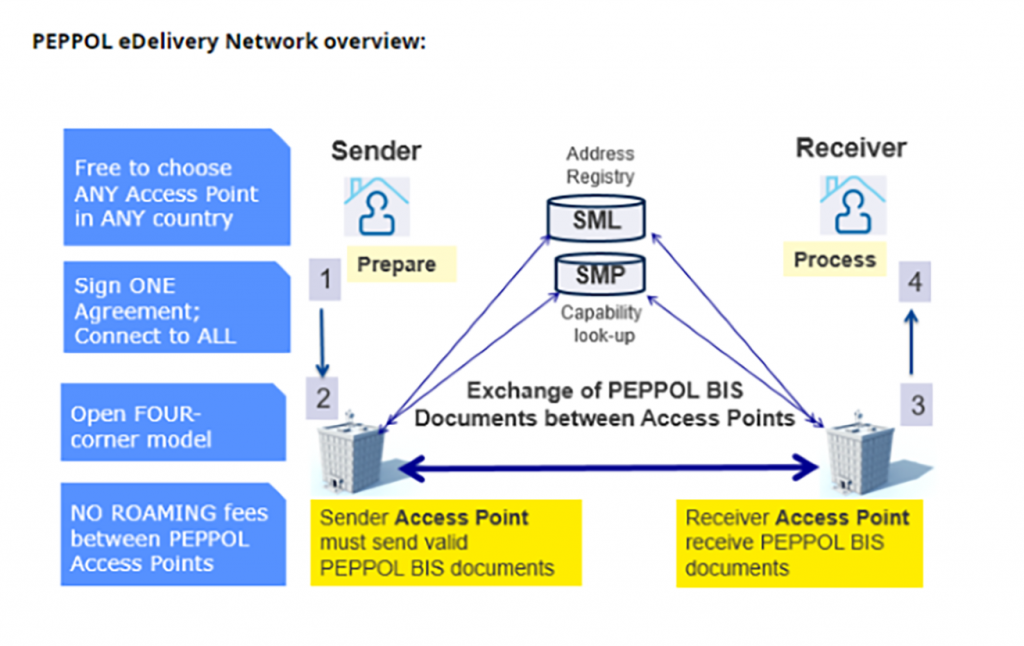

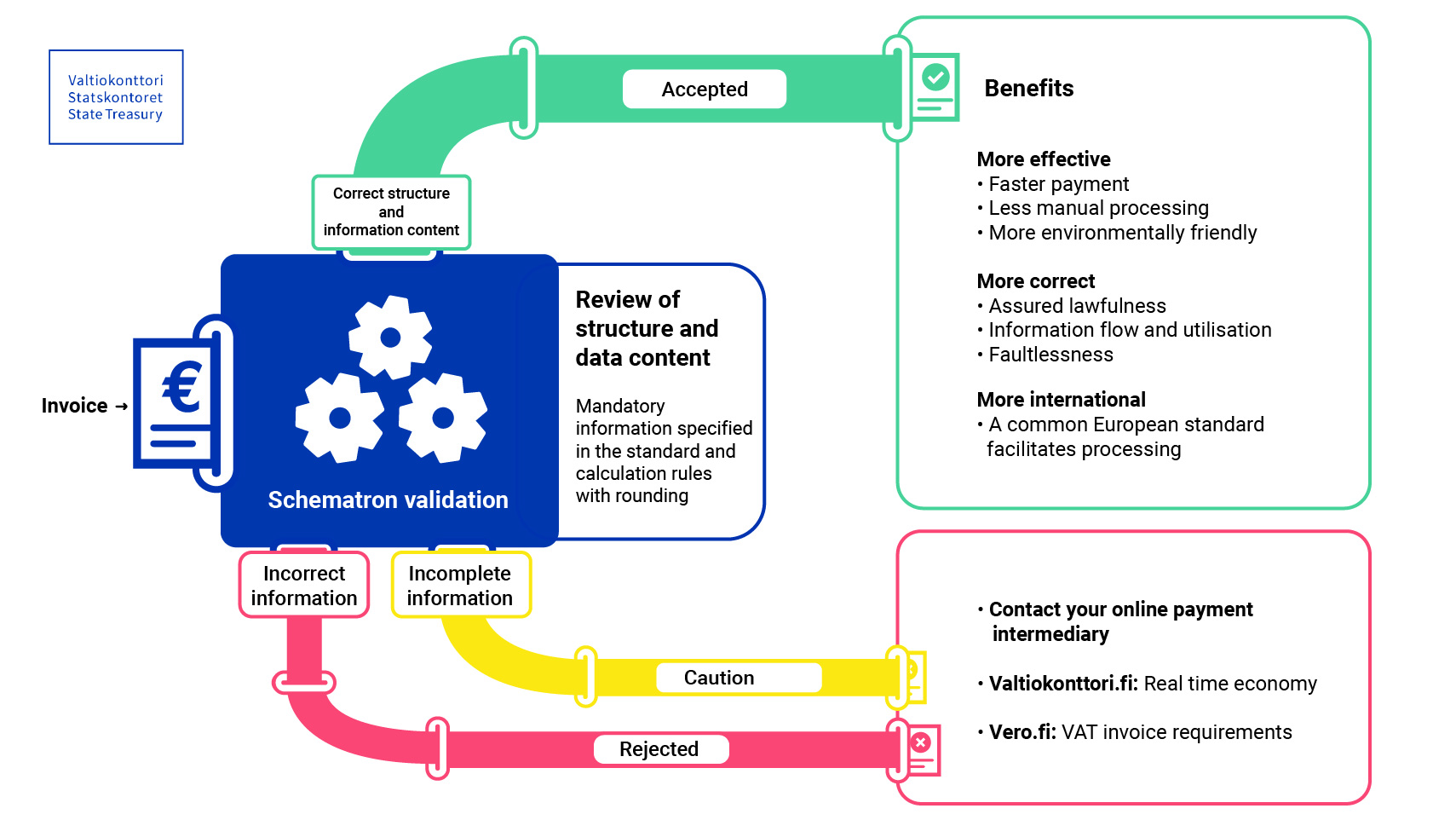

Real-time economy supports companies’ transition to fully automated financial administration. Elements of the real-time economy comprise e-invoices, digital receipts and electronic procurement messages. It has been estimated that by using electronic communication, companies could save working time and costs amounting to hundreds of millions of euros every year.